Affordable Homes: Not If You Are First Time Buyer!

Year in, year out, the same rhetoric is given by the government showing concern for the lack of housing being built on an annual basis. And guess what, year in, year out, we as a nation fail to deliver the expected numbers of houses. Being a first time buyer looking for a step on the property ladder is getting harder and harder.

That’s OK though isn’t it? ”Estate agents across the land are still in work, so it cant be that bad right?”, ”Houses are still being bought and sold”. No, it is bad. Bad for those thousands of First Time Buyers in this country, who are stretched to even save a 5% deposit to qualify for one of the available ‘Help to Buy’ schemes.

Each year the population increases, house prices rise, the cost of land increases, material costs rise and criteria for lending gets tougher, yet salaries remain pretty much stagnant unless you are one of the fortunate few.

This combination in real terms makes if incredibly difficult for first time buyer to step foot on the property ladder.

The gap between affordable and obtainable in the context of house ownership are polar worlds apart and getting further apart every day. The income to house price ratios are simply ridiculous and ever increasing but it seems nothing changes. Nothing.

Where are the waves of affordable homes promised, where is the additional land being released by local authorities for new affordable housing stock? Where are the house builders offering affordable homes in their droves?

Anyone?? No??

OK, there are new affordable homes going up across the country, the Government & media publicise this all the time and new developments are popping up in many towns and cities in the land. However, I am talking about affordable in the sense of properties that are being built to be sold to a first time buyer at a reasonable rate.

Just take a look at the Governments definition of ‘Affordable’ according to Gov.uk:

Affordable housing is social rented, affordable rented and intermediate housing, provided to eligible households whose needs are not met by the market.

So yes, there are many of these ‘affordable’ schemes being built and released to the market but the proportion of the intermediate housing (for purchase through a help to buy scheme) is minimal. The majority are for rented occupation.

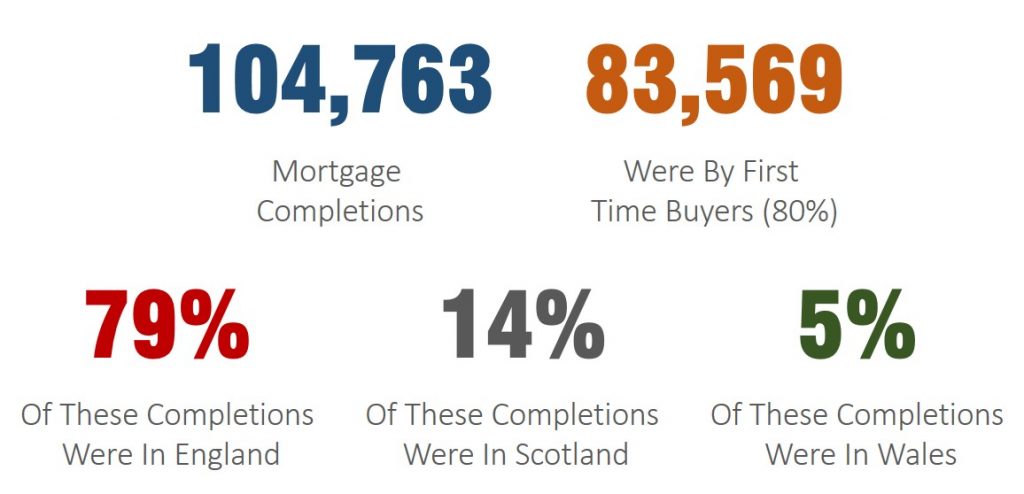

According to the Help to Buy mortgage guarantee scheme statistics from 8th October 2013 to 30th June 2017

there were:

These numbers seem reasonable but considering this is nearly four years worth of data, its a small number of first time buyers coming to the market in the UK every year, averaging around 20,800 completions per year.

Salary To House Price Ratio

One of the fundamental reasons why completions are so low is down to affordability. Looking at the average house price in England as it currently stands today: £243,520 based on House Price Index Aug 2017 ref:Gov.uk (excluding the average cost in London at £484,000) and divide that by the average UK salary (£27,064 based on full time employment status ref:Monster Jobs) you get = 8.99.

I’m no mathematician, but already there’s a problem right. Not exactly affordable (Even worse using London house prices). The chances of obtaining a mortgage using the above ratio are pretty slim.

Now do the same sum using average salary and house price from August 1999:

Average house cost @ £72,300 / Average salary @ £20,800 = 3.475.

It speaks for itself. House prices are simply way off the scale when it comes to affordability, the demand has forced prices up at the detriment of the first time buyer. However you look at it or what set of data you use, the results will be the same. Buying a house is no longer affordable for the majority.

Some may suggest that if a couple living together were both earning the average salary then it would fall under the five times ratio. True, but not all first time buyers are coupled up, ready to take that step, particularly when the borrowings and associated risks are so high, or are turned down at application stage by ever increasingly strict mortgage lending criteria.

As a first time buyer, your options are limited. So what to do, sit back for a few years, save another few thousand to top up your deposit…. sensible, but then the house price increase in the same period has just absorbed your additional savings and then some so you are no better off.

So what have we got:

House prices rising on an annual basis

Lack of new affordable homes being built

Fewer mortgages being approved

Annual wage growth is low (stagnant within the public sector)

Food costs rising

Utility/Council tax bills rising annually

It’s a list of hefty negatives to contend with if you are considering stepping foot on the property ladder any time soon and shows no signs of stopping.

The fortunate may be banking on inheritance to take their first step, but the majority have no choice but to sit back, save and hope that things change and one day become affordable. But will this ever happen?

Answers on a postcard please.